The 721 exchange, similar to the 1031 exchange, allows an investor to defer capital gains taxes while relinquishing control of a property held for business or investment purposes. Both tax mitigation strategies offer investors strong alternatives to a traditional sale, in which taxes can exceed 20--30% of capital gains (use our capital gains tax calculator to estimate yours).

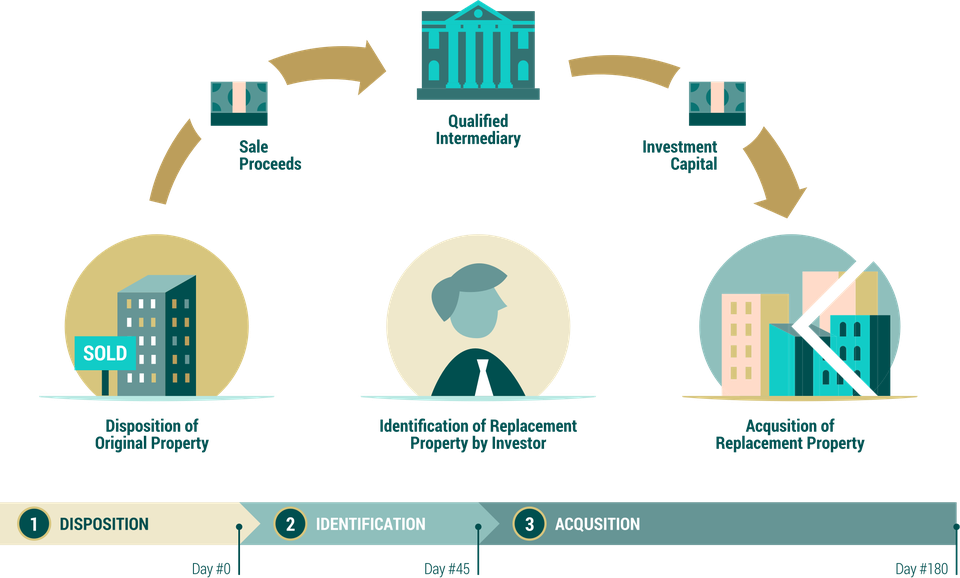

The 1031 exchange allows an investor to defer capital gains taxes by selling investment property and reinvesting the proceeds in a like-kind asset.

The 1031, however, may not meet the goals of some investors. For example, an investor may be attracted to the stable income, tax benefits, and potential appreciation that can be provided by a REIT investment, which would not satisfy the requirements for a 1031 exchange.

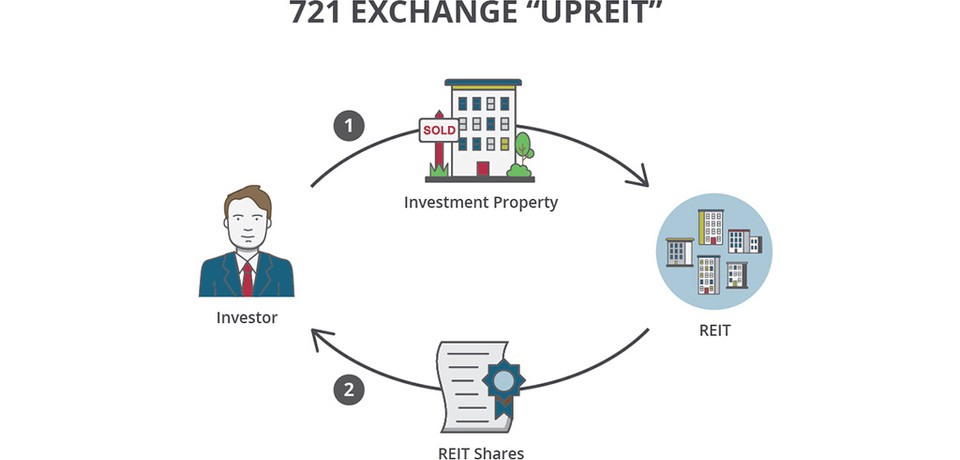

In a 721 exchange a real estate investor may defer capital gains taxes on the disposition of a property while acquiring shares in a REIT.

This article answers the following questions:

-

How does a 721 exchange work?

-

What are the primary benefits of a 721 exchange?

-

Can an investor combine a 1031 exchange with a 721 exchange?

-

Can an investor perform a 1031 exchange after a 721 exchange?

How does a 721 exchange work?

In a 721 exchange, or "UPREIT", an investor contributes property to a REIT in exchange for units in an operating partnership that will then be converted into shares of the REIT itself.

What are the primary benefits of a 721 exchange?

Passive Income

REIT shareholders are passive. Managers oversee the operation of the REIT and manage its assets. This allows investors to have a hands-off approach while the managers handle the day-to-day decision-making process for the portfolio of assets. The investors receive communication about acquisitions, dispositions, and distributions, but will not be involved in any of these decisions.

Tax Advantages

Due to the structure of a 721 exchange, the gains on the sale of a property will be deferred. In a typical sale, the gains that are realized as part of the sale would be subject to tax. This tax plus the tax on depreciation used to offset property taxes can sometimes exceed 25% of the gains you would receive upon sale. This leaves the investor with a substantially less amount of capital that can be used for another investment. With a 721 exchange, the investor would avoid the costly taxes and be able to use 100% of the gains on sale to purchase shares of a REIT. This strategy must be weighed against the fees that are required to complete the 721 exchange in order to purchase the REIT shares.

Diversification

Due to the 721 exchange allowing an investor to purchase shares of a REIT, there are numerous diversification benefits. Generally speaking a REIT will have properties located in many different geographic locations, as well as having tenant, industry, and sometimes asset class diversification. As a shareholder of the REIT, the investor would no longer have their interests in a single asset. The REIT will provide the similar benefits of appreciation of the Real Estate, depreciation tax shelter, and income (in the form of dividends).

Estate Planning

When an investor is preparing to pass down their assets to their next of kin, the 721 exchange is a strategy that is often used and is beneficial. Physical real estate is often difficult to sell and can lead to conflicts in the division of the assets. However, if the estate should exchange by way of 721, they will still receive all of the benefits during their lifetime, and upon passing, the shares can be split equally and either held or liquidated by the heirs of the trust. Since the shares are passed through a trust, the heirs will receive a step-up in basis and will avoid all capital gains and depreciation recapture taxes that were deferred by the estate.

Can an investor combine a 1031 exchange with a 721 exchange?

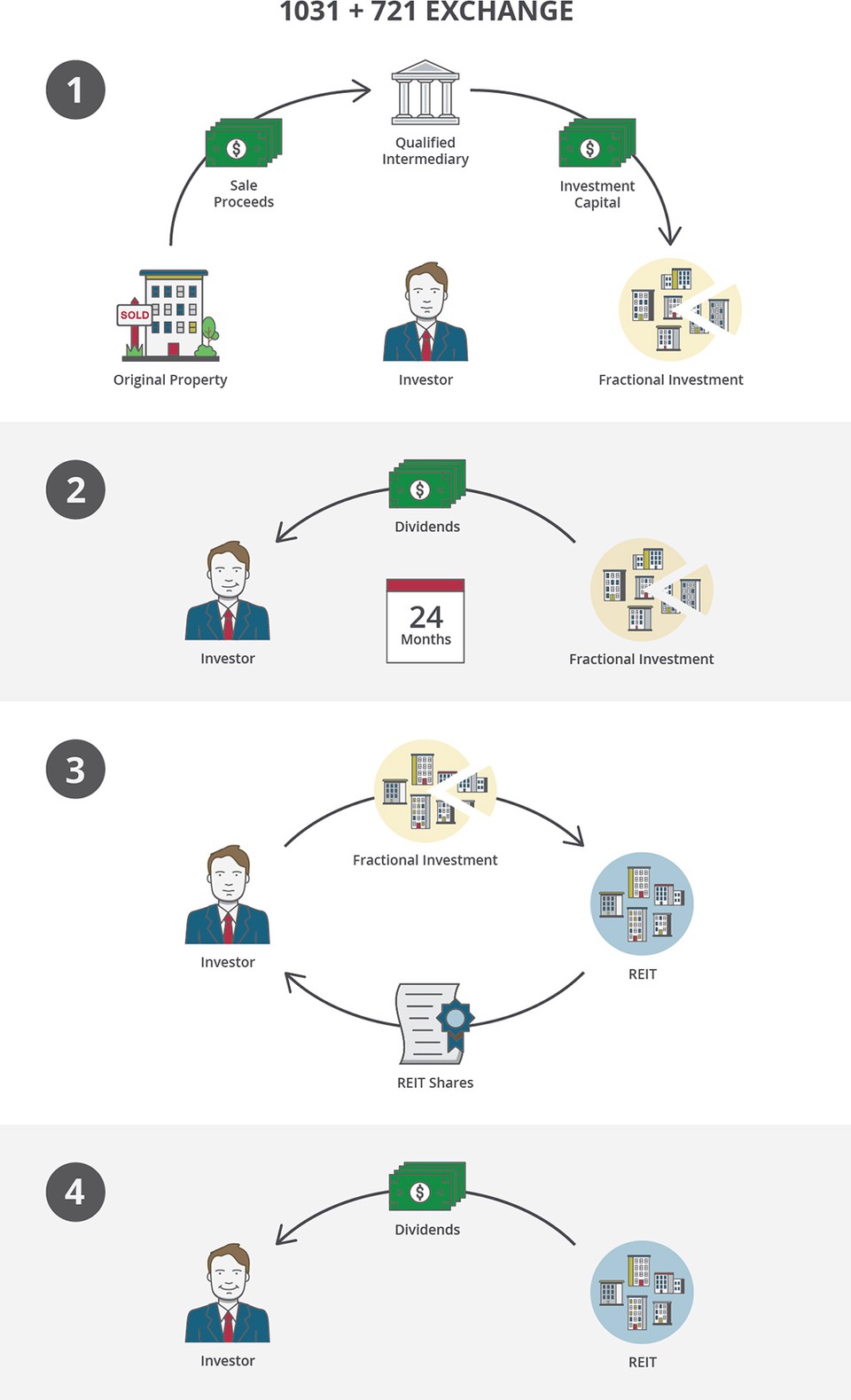

Every REIT has specific acquisition criteria, and it is unlikely that the property a given individual wants to relinquish meets the criteria of the REIT the investor wants to invest in. The solution is to combine a 1031 exchange with a 721 exchange, which allows one to acquire a fractional interest in institutional grade property that meets the criteria of the REIT the investor wants to invest in.

This fractional investment must be held for a sufficient amount of time (typically around 24 months) to keep the 1031 exchange in tact. The good news is that the investment may pay dividends out to the investor throughout this period. After this point the fractional investment can be contributed to the REIT in exchange for operating partnership units based on the value of the property. These units will then be exchanged for direct ownership of shares in the REIT.

Can an investor perform a 1031 exchange after a 721 exchange?

REIT shares themselves are not eligible to be used in a 1031 exchange, and therefore once a 721 exchange is completed, this is the end of the line for deferral of capital gains taxes. If the shares of the REIT are sold, or the REIT sell a portion of the portfolio and returns capital to the investors, the investors will be required to recognize any capital gain or loss when they file their taxes.